Bihar Board 12th Accountancy Important Questions Long Answer Type Part 1 in English

Bihar Board 12th Accountancy Important Questions Long Answer Type Part 1 in English

Question 1.

How Income and Expenditure account is made from receipt and payment Account ?

Answer:

Income and expenditure account is prepared from receipts and payments account and additional information.

Steps involved in preparation of Income and expenditure account following are the steps to be taken care while preparing income and expenditure account from receipts and payment A/c.

Step 1: Items not to be shown in income and expenditure A/c.

Persure the R/ PA/ c throughly and exclude the following items as they are not revenue nature items. In other words do not show these items in income and expenditure account.

(i) Opening cash and bank balance: They are recorded in opening balance sheet.

(ii) Reserve and surplus : Match fund, sports fund, price fund, cricket fund, tournament fund etc. are shown in liabilities side of the balance sheet.

Step II: Items to be shown in income and expenditure A/c

(i) Revenue income/Receipts: As certain the revenue receipts and income appearing an credit side of R/PA/ c of subscription, real, interest, sale of old newspaper, creature fees, etc. and show then on the income side of income and exp- A/c. In case of additional adjustments :

(i) Exclude (i.e. substract) the amounts relating to the proceeding and succeeding persons.

(ii) Include the amounts relating to the current year not yet received or received in earlier year.

Step III: Non-cash Items : Ascertain the following non-cash item not appearing in the receipt and payment A/c. Their items are given in additional information. Show these items on the debit side or credit side of income and expenditure A/c.

Step IV: Surplus/deficit: Lastly, calculate the difference between credit and debit side amount. If the total of income side is more than that of the expenditure side, it will indicate surplus. If the total of expenditure side exceeds that of the income side it will be called deficit.

Question 2.

What is Partnership Deed ? Describe its contents.

Answer:

Partnership Deed/Agreement

Meaning: A written document containing the terms of agreement between the partners pertaining to the rights and duties of partners is known as Partnership Deed or Partnership Agreement. It is also known as Articles of Partnership. It may be written of oral but due to uncertainty it must be written (and registered).

It generally contains the details about all the aspects affecting the relationship between the partners including the objective of business, contribution of capital by each partner, ratio in which the profits and losses will be shared by the partners. A partnership deed generally includes the following:

Contents of Partnership Deed :

- The name and address of the firm and its main business.

- Names, addresses and occupations of partners.

- The amount of capital to be introduced by each partner.

- (a) Rate of interest on capital, loan and drawings etc.

(b) Salary, commissions etc. payable to partners. - The profit sharing ratio of the partners.

- Date of commencement and duration of the business.

- The amount to be allowed to each partner for drawing and the timing of such drawings.

- The method by which goodwill is to be valued and assets and liabilities to be revalued on joining, retirement or death of a partner,

- The rights, duties and liabilities of each partner.

- The procedures to be followed in case of admission, retirement, death of a partner.

- The accounting period of the firm.

- The procedure to be followed for settlement of disputes among the partners,

- Preparation of accounts and their audit, etc.

- Procedure for dissolution of the firm.

- Duration of partnership.

- Methods of preparing accounts.

Partnership deed should be signed by all the partners. It must be stamped in accordance with the Iridian Stamp Act. It should preferably by registered with‘the registrar of firms to avoid conflicts/disputes.

Importance/Impact: Partnership arises out of an agreement. Partnership deed is the written agreement which contains the important terms of partners between themselves. Partnership deed defines the rights, duties and liabilities of the partners as well as of firm. Partnership deed helps to avoid disputes between partners in future. In the absence of partnership deed, it is difficult to sustain the partnership. Thus, partnership deed facilities smooth functioning of the firm.

Question 3.

Differentiate between Receipts and Payments Account & Income

and Expenditure Account.

Answer:

Difference between Receipts and Payments A/c and Income and Expenditure A/c .

Question 4.

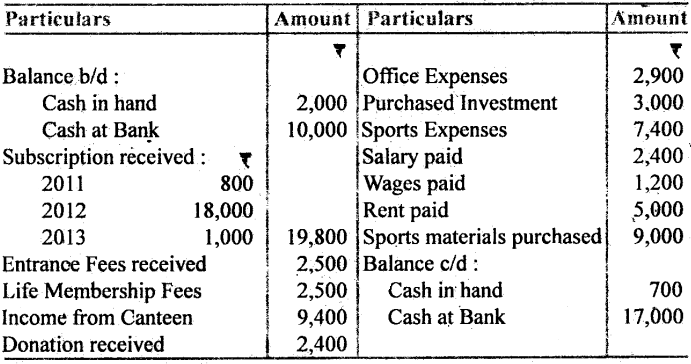

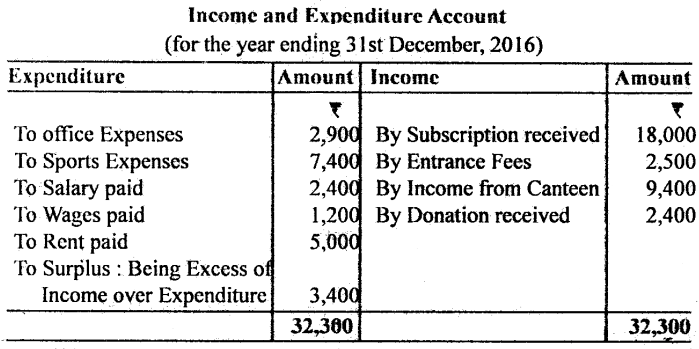

From the following information, prepare an Income and Expenditure, Account for the year ending 31st December, 2016:

Answer:

Working Notes:

- Life Membership Fee has been assumed as a capital receipt. It will be added in Capital Fund in liabilities side,

- Donation received is in the nature of donation recurring. So it is assumed as income.

- Purchased Investment is capital expenditure, so it has not been shown in Income and Expenditure Account.

- Sports Material Purchased is capital expenditure, so it has not been shown in Income and Expenditure Account.

Question 5.

What a Goodwill ? Discuss ike factors which affect the value of Goodwill Or, What is Goodwill ? I low its value is determined ?

Answer:

Meaning of Goodwill: Goodwill is die good name or reputation enjoyed by a firm that enables it to earn higher profits than the normal profits.

Any firm that earns normal profits or is incurring losses has no goodwill.

Thus, Goodwill is

- the benefit and advantage of good name and reputation.

- attractive force which brings in customers.

- one thing which distinguishes an old established business from a new business.

Factors affecting the value of Goodwill:

The goodwill is a composite thing. It is influenced by a number of factors. In fact, all the factors which help a firm in earning profits affect the value of goodwill of the firm.

The following factors affect the value of goodwill:

1. location: A favourable location of the business helps to a gfeat extent in attracting customers. It increases profitability and thus also the value of goodwill.

2. Nature of Business : The nature of business also affects the value of goodwill. The nature of business includes :

(a) The nature of goods: The more stable business is the more is goodwill and vice-versa.

(b) Risk involved : The more the risk involved in business, less is the goodwill.

(c) Monopolistic nature of business: it enhances the value of goodwill.

(d) Benefits of patents and trademarks; and

(e) Easy excess of raw materials; etc.

3. Time : A business order in age will have more goodwill since it is’ better known to the customers,

4. Capital Required: if the two business enterprises can earn same rate of profit, the business requiring,less capital shall have more goodwill.

5. Trend of Profits : Value of goodwill may also be affected due to fluctuation in the amount of profit. Rising trend of profits leads to higher amount ofigoodwill. Declining profits will reduce the value of goodwill.

6. Efficiency of Management: A firm endowed with good management is capable of earning good profit. This enhances the value of goodwill.

7. Personal Qualities : Goodwill may defend upon businessman’s own value, personality and relations, which may depend upon his truthfulness, hard work, good nature, experience etc.

8. Other Factors:

- Protected valuable patents, copyright, trade marks;

- Condition of money market;

- Government patronage and its policy;

- Good industrial relations;

- Research and development efforts;

- Production of good quality product

Methods of Determination of Goodwill;

There are three important methods of valuation (determination) of goodwill.

1. Average Profit Method

(i) Simple Average Profit Method (Number of Years’ Purchase of Average Profit Method)

Under this method, goodwill is valued on the basis of agreed number of years’ purchase of the average profit of the last few years. So this method, involves two steps : .

(a) Calculation of average profit of the recent past years (say 3 years off 4 years or 5 years).

(b) Then the average profit is multiplied by the number of years’ purchase as agreed upon by the partners to determine the value of goodwill.

Usually goodwill is taken to be equal to three years’ or five years’ purchase of average profit.

Symbolically, Goodwill = Average Profit × Number of Years’ Purchase

(ii) Weighted Average Profit Method (Number of Years’ Purchase of Weighted Average Profit Method)

Under this method goodwill is valued as under:

(a) Each year’s profit is multiplied by the respective number of weights, e.g., 1,2, 3, 4 or 5 etc.

(b) Then all the products are totalled up to find out the value of product.

(c) The total of all the products is divided by the total number of weights for determining the weighted average product.

(d) Lastly, the value of goodwill is ascertained by applying the following formula:

Value of Goodwill = Weighted Average Profit × No. of Years’ Purchase

2. Super Profit Method

Under this method, super profit constitue the basis of calculation of the value of goodwill. And hence, goodwill is calculated by multiplying the super profits by a reasonable number of years, such as, 2 years’ purchase, 3 years’ purchase etc.

Thus, Goodwill = Super Profit × Agreed Number of Years’ Purchase

Procedure of Calculating Goodwill under Super Profit Method :

Step 1 : Find out actual average profit or future maintainable profit of the business.

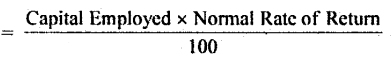

Step 2 : Find out normal profit. If nprmal profit is not given in the question, use the following formula to get normal profit:

Normal Profit

Capital Employed = (i) Net Fixed Assets + Working Capital –

Or, (ii) Share Capital + Reserves & Surplus + Long term Debts – Miscellaneous Expenses to the extent not written off

Thus, capital employed means the total funds provided by the owners (i.e., partners).

Step 3 : Calculate super profit, i.e., Actual Average Profit – Normal Profit

Step 4 : Calculate the value of goodwill by multiplying the super profit by the agreed numbers of years’ purchase.

Goodwill = Super Profit × Number of Years’ Purchase

(1) Actual Profit/Estimated Profit of Business : Valuation of goodwill by super profit method adjusted/actual profit has been calculated.

(2) Meaning of Normal Profit: Normal profit means a reasonable return on capital employed, i.e., profit earned by similar type of firms having the same degree of business risk.

Normal rate of return means the rate of earning which partners or investors expect on their investments in a particular type of business. So it may differ from business to business, industry to industry and place to place.

(A) Average Capital Employed : After deducting short term and long-term liabilities the amount which remains is called capital employed. To ascertain the amount of capital employed all assets should be included and fictitious assets and non-trading assets should be deducted. For example, Investment out of trade, Goodwill, Preliminary Exp., Discount on Issue of shares and debentures and Underwriting commission.

Capital Employed = (i) Net Fixed Assets + Working Capital Or,

(ii) Share Capital + Reserves & Surplus + Long term Debts – Misc. Exps. to the extent not written off

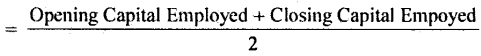

(i) Average Capital Employed

(ii) Average Capital Empoyed

= Closing Capital Employed –

(iii) Average Capital Employed „

= Opening Capital +

(B) Normal Rate of Return: Normal rate of return is the return which is expected by an investor from his investment. This rate is also called reasonable rate of return.

Normal Profit

(C) Meaning of Super Profit: Super Profit is the excess of average profit of the business over the normal profit.

Super Profit = Actual Average Profit – Normal Profit

Here, actual average profit denotes adjusted profit.

(D) Calculation of Goodwill:

Value of Goodwill = Super profit × No. of Years’ Purchase Thus, Goodwill = (Average Actual Profit – Normal Profit) × No. of Years’ Purchase

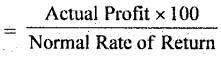

3. Capitalisation Method:

According to capitalisation method, goodwill can be calculated in the following ways:

(i) By capitalising the average actual profits.

(ii) By capitalising the super profit.

(i) Capitalisation of Average Actual Profit Method :

Under this method, goodwill is the difference between the normal capital employed, i.e., capitalised value of the business and the actual capital employed. Thus,

Goodwill = Capitalised Value of Business – Actual Capital Employed or Goodwill = Capitalised Value of Business – Net (Tangible) Assets Capitalised Value of Business or Total Value of Business

Net Tangible Assets or Capital Employed

= Total Tangible Assets – Outside Liabilities

Question 6.

X, Y and Z were partners in a firm sharing profits in the ratio of 2 : 2 : 1. Their Balance Sheet as at March 31,2016 was as follows :

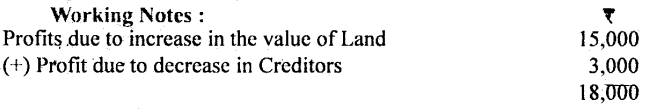

From 1 April, 2016 the partners decided to share profits in the ratio of 1: 2 : 3 for this purpose it was agreed that:

(i) The goodwill of the firm should be valued at ₹ 60,000.

(ii) Land should be revalued at ₹ 1,00,000 and Building should he depreciated by 6%.

(iii) Creditors amounting to ₹ 3,000 were not to be paid. You are

required to:

(a) Record the necessary Journal entries without giving effect to the above agreement.

(b) Prepare the capital accounts of the partners.

(c) Prepare the Balance Sheet of the reconstituted firm.

Answer:

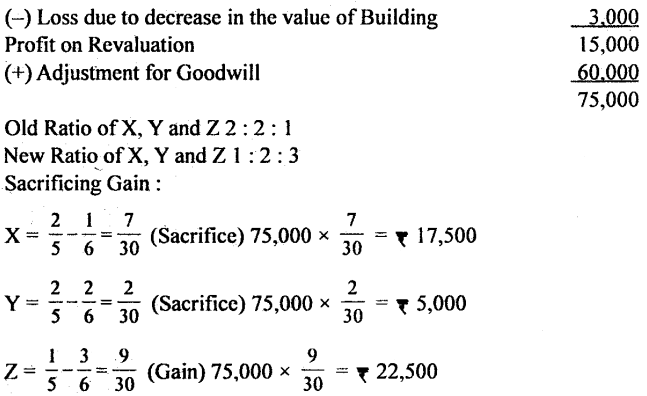

(iii)

Question 7.

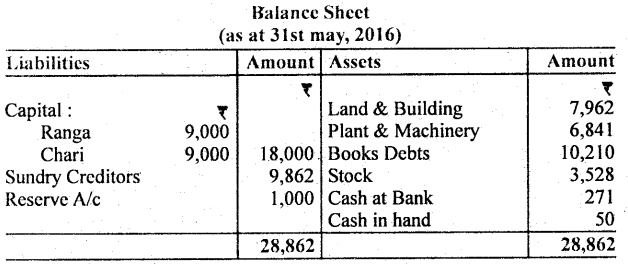

Ranga and Chari are equal partners. On 1st June, 2016, they agreed to admit Philips as partner. Philips had to pay ₹ 2,000 as premium, they money to he left in the business and contributes ₹ 5,000 as capital for 1/3 share in business. The Balance Sheet of Ranga and Chari as at 31st May, 2016 was as follows :

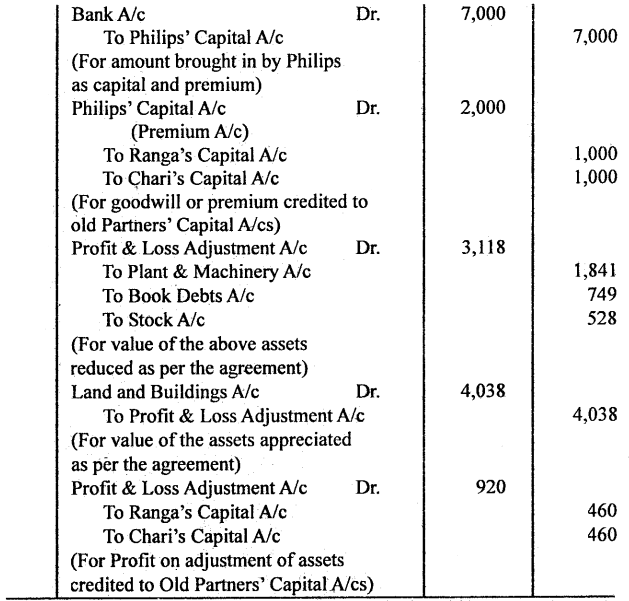

It was agreed the following adjustments in the book values were to be made:

(a) Land and Building to be valued at 7 12,000,

(b) Plant and Machinery to be reduced to x 5,000,

(c) Bad debts to be written off x 749,

(d) Stock to be valued at x 3,000,

(e) Reserve Account to be shared equally between Ranga and Chari.

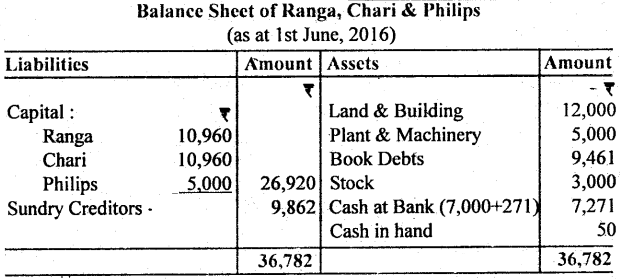

Show Journal entries and prepare the Balance Sheet of the new firm.

Answer:

Question 8.

What are limitations of Financial statement ?

Answer:

Financial statement : Following are the limitations of financial statements:

(i) Based on Historical Data: Financial statements are based on historical data while parties are more interested in knowing the present position and future prospectus of the business enterprise.

(ii) Based on traditions and conventions: Financial statements are prepared based on traditions and conventions.

(iii) Ignore Qualitative Aspect : Financial statements provide only financial information, and ignor qualitative aspects, because they cannot be expressed in money terms. Thus, working conditions, customer satisfaction, efficiency of management etc. are ignored and omitted.

(iv) Ignore Price Level Changes : Financial statements record data at historical cost. So they ignore the price level changes or present, value of the assets.

(v) Influenced by Personal Judgements : Financial statements are influenced by personal judgements of the accountatns. On many issues more than one methods are permitted. Method of depreciation, mode of amortisation, valuation of stock, valuation of goodwill etc. all depend upon the personal judgements of the policy-maker of the enterprise.

(vi) Financial Statements are only Interim Reports: Financial statements are essentially interim reports. They cannot be finall. The actual profit or loss of a business can be determined only when the business is ultimately closed. The existence of contingent assets and liabilities, deferred revenue expenses make the statement less accurate and more subjective.

Question 9.

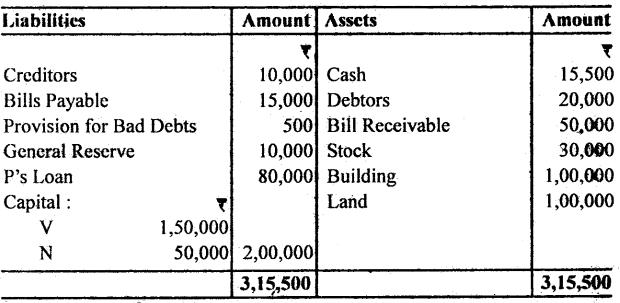

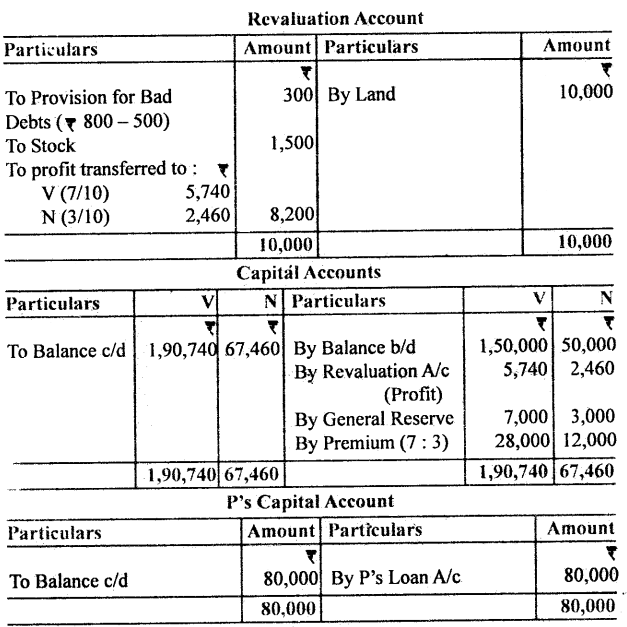

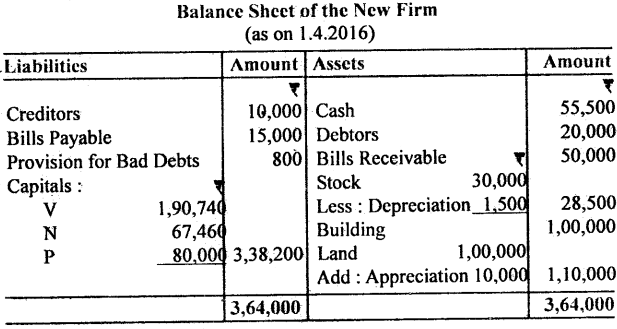

V and N were partners in a firnt sharing profit in the ratio of 7; 3. Their Ruhmce Sheet as on 31.3.2016 was as follows:

On 1,4.2016 they admitted P as a new partner on the following terms:

(i) P will get 1/5th share in the profits of the firm,

(ii) P’s loan will he converted into his capital,

(iii) The goodwill of the firm was valued at ₹ 2,00,000 and P brought his share of goodwill (premium) in cash,

(iv) Provision for bad debts was to be made equal to 4% debtors, (v) Stock was to be depreciated by 5%,

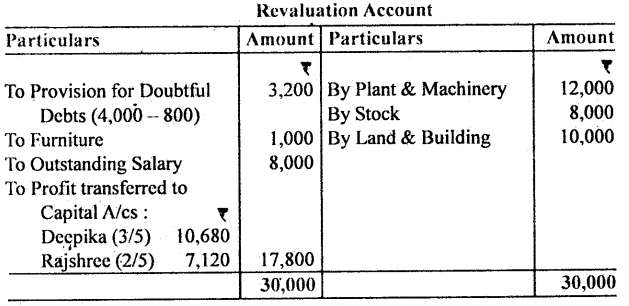

(vi) Land was to be appreciated by 10%. Prepare Revaluation Account and Capital Accounts.

Answer:

Question 10.

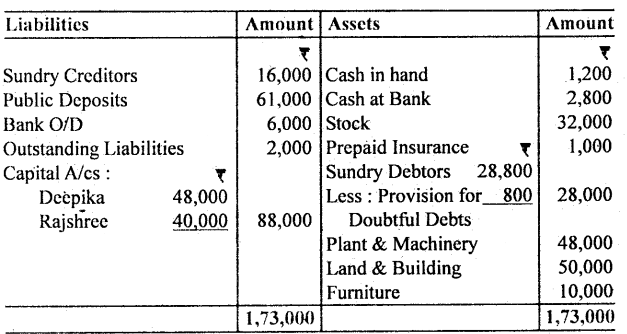

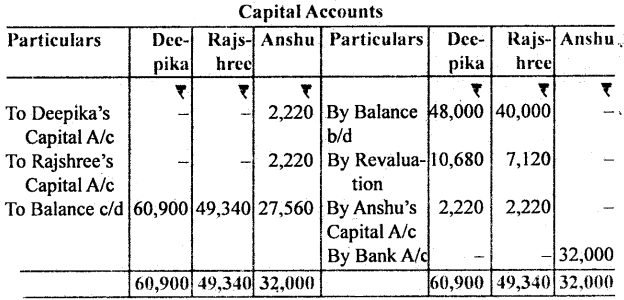

Deepika and Rajshree are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st December, 2016; their Balance sheet was as under:

On the above date, the partners decide to admit Anshu as a partner on the following terms:

(i) The new profit-sharing ratio of Deepika, Rajshree and Anshu will be 5: 3 : 2 respectively.

(ii) Anshu shall bring ₹ 32,000 as his capital.

(iii) Anshu is unable to bring in any cash for his share of goodwill. Partners, therefore, decide to calculate goodwill on the basis of Anshu’s share in the profits and the capita! contribution made by him to the firm.

(iv) Plant and Machinery is to be valued at ₹ 60,000; stock at ₹ 40,000 and the provision for doubtful debts is to he maintained at ₹ 4,000. Value of land and building has appreciated by 20% and furniture has depreciated by 10%.

(v) There is an additional liability of ₹ 8,000 being outstanding salary payable to employees of the firm. This liability is not included in the outstanding liabilities, stated in the above Balance Sheet. Partners decide to show this liability in the hooks of accounts of the reconstituted new firm.

Answer:

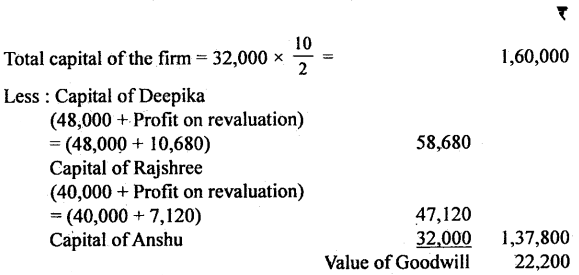

Working Notes:

As the amount of goodwill is hidden it can be worked out as follows:

Anshu’s share of Goodwill = 22,200 ×

Deepika and Rajshree will be credited in their sacrificing ratio i.e., equally,

Sacrifice made by Deepika =

Sacrifice made by Rajshree =