Bihar Board 12th Accountancy Important Questions Short Answer Type Part 3 in English

Bihar Board 12th Accountancy Important Questions Short Answer Type Part 3 in English

Question 1.

What a meant by Partnership?

Answer:

Meaning of Partnership: When two or more persons enter into an agreement for setting up a business, to fun it and share the profits and losses, it is termed as partnership.

As per Section 4 of the Partnership Act, 1932 :

“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

This definition highlights following three elements or conditions to determine whether an association of persons is a partnership or whether a person is a partner in a firm :

- There must be an agreement between all the partners;

- The agreement must be to share the profit of a business; and

- The business must be carried on either by all partners or any of them acting for all.

Question 2.

Write four items relating to not-for-profit organisation.

Answer:

There are four items relating to Not for profit organisation are as follows :

- Subscription

- Donation

- Legacies

- Honorarium.

Question 3.

Under which circumstances of a partnership firm is deemed to be dissolve.

Answer:

The main reasons of dissolution of partnership firm are as following :

- On retiring of a partner

- On death of a partner

- On insolvent of a partner

- On the situation of oldness of enterprise

- On in liable of a partner.

Question 4.

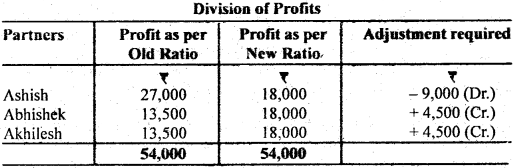

Ashish, Abhishek and Akhilesh have been sharing profits in the ratio 2 : 1 : 1 respectively in a firm. The firm has existed for some years. Sow they decide to share profits equally and that too, with retrospective effect from 2013. The profits for the last three years were: 2013 – ₹ 20,000, 2014 – ₹ 10,000, 2015 – ₹ 16,000. Show the adjustment of profits for the last three years by means of Journal entries.

Answer:

Total profits of last three years

= ₹ 20,000 + 18,000 + 16,000

= ₹ 54,000

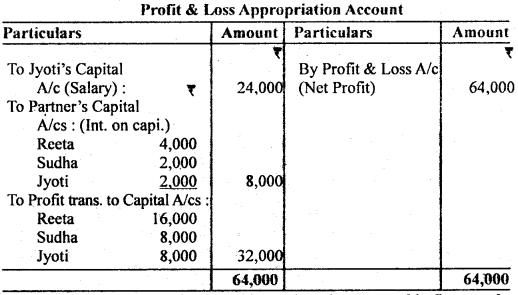

Question 5.

Reeta, Sudha and Jyoti were partners in a firm. On 1st January, 2011 their capitals stood at ₹ 40,000, ₹ 20,000 and ₹ 20,000 respectively. As per the provisions of the partnership deed (i) Jyoti was entitled for a salary of ₹ 2,000 p.m. (ii) Partners were entitled to interest on capital at 10% p.a. (iii) Profit to he shared in the ratio of capitals. The profit for the year 2011 was₹ 64,000.

Prepare Profit & Loss Appropriation Account.

Answer:

Question 6.

Write the name of occasions when the partnership firm can be reconstituted.

Answer:

Occasions of Reconstitution of a Firm :

- Change in the profit-sharing ratio among the existing partners.

- Admission of a new partner.

- Retirement of an existing partner.

- Death of a partner.

- Amalgamation of two (or more) partnership firms.

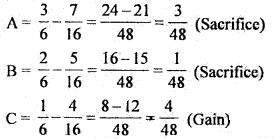

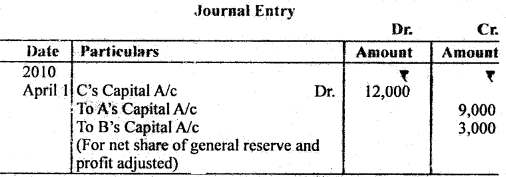

Question 7.

A, B and C are partners in a firm sharing in the ratio of 3 : 2 : 1. On 1st April, 2010 they decide, to share the profits in future in the ratio of 7 : 5 : 4. On this date General Reserve is ₹ 76,000 and profit on revaluation of assets and liabilities being ₹ 68,000. It was decided that adjustment should be made without altering the figures in the Balance Sheet Make adjustment by Single Journal entry.

Answer:

Step 1: Calculation of Sacrifice/Gain of Partners :

Sacrificing share = Old share – New Share

Step 2:

General Reserve – ₹ 76,000

Profit on Revaluation – ₹ 68,000

Total Value (Cr.) – ₹ 1,44,000

Hence; Proportionate Share of Profit of Gaining Partner

= ₹ 1,44,000 ×

Proportionate Share of Sacrificing Partners

A : 1,44,000 ×

B : 1,44,000 ×

Step 3:

Question 8.

The profit and losses earned by a business over the lasts years are as follows:

₹ 12,000 (profit), ₹ 13,000(profit), ₹ 14,000 (profit),₹ 18,000(profit) and ₹ 2,000 (loss).

Find out tire value of goodwill if it is based on 2 limes of the average profit of last 5 years.

Answer:

Calculation of Total Profit:

Average Profit =

Goodwill = Average Profit × No. of Years’ Purchase

= 11,000 × 2 = ₹ 22,000

∴ Value of Goodwill = ₹ 22,000.

Question 9.

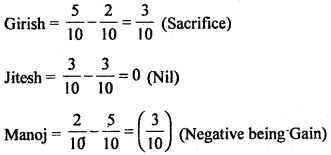

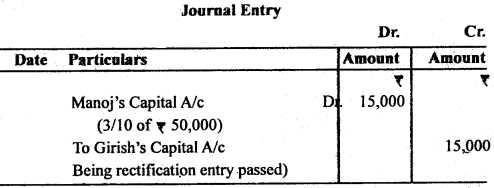

Firm of Girish, Jitesh and Manoj earned profits of ₹ 50,000 during the year 2011, which was distributed among the partners in the ratio of 5 : 3 : 2, whereas it should be in the ratio 2 : 3 : 5. Given Journal entry for the rectification.

Answer:

Calculation of Gain or Sacrifice share of Partners:

Sacrificing = Old share – New share

Step 3:

Question 10.

What is Revaluation Account? Give the format of Revaluation Account.

Answer:

Revaluation Account: devaluation Account is a nominal account. Revaluation Account is credited with the increase in the value of assets and decrease in the value of liabilities. In addition, Revaluation Account is debited with the increase in the value of liabilities and decrease in the value of assets. Excess of credit side over debit side (i.e., profit) or Excess of debit side over credit side (i.e. loss) is distributed among the old partners in their profit-sharing ratio. It should be noted that the new partner is not affected by revaluation of assets and liabilities. After the revaluation, assets and liabilities are shown in the new Balance Sheet at the revised/revalued figures.

Question 11.

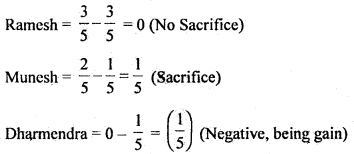

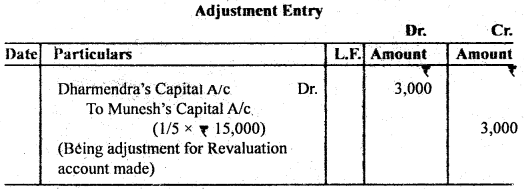

Ramesh and Munesh are partners sharing Profit & Loss in the v ratio of 3 : 2. They admit Dharmendra as a new partner. The new ratio is decided to be 3 : 1 : 1. The debit balance of Memorandum Revaluation Account is ₹ 15,000.

Pass an Adjustment entry for the above.

Answer:

Calculation of Sacrificing ratio:

Sacrifice = Old Share – New Snare

Question 12.

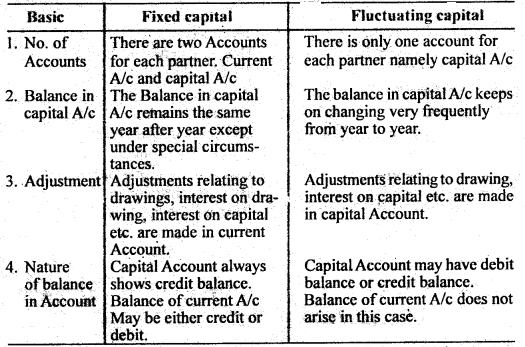

Distinguish between Fixed capital and Fluctuating capital.

Answer:

Following are the differences between Fixed and Fluctuating capital A/c:

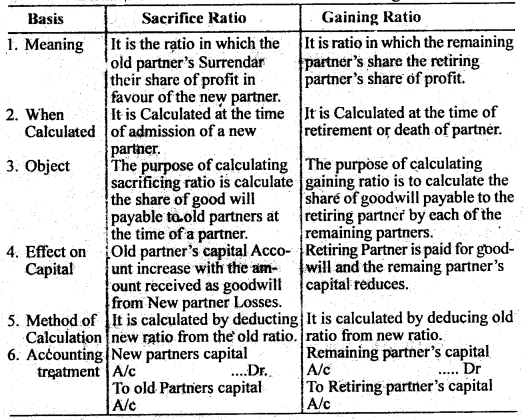

Question 13.

Distinguish between Sacrifice Ratio and Gaining Ratio.

Answer:

Distinguish between Sacrifice Ratio and Gaining Ratio :

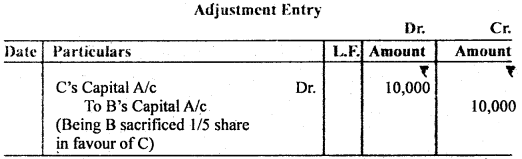

Question 14.

In a firm A and B are partners sharing profit in 3 : 2 ratio. Their fixed capitals are ₹ 30,000 and ₹ 20,000 respectively. After admission of C, their new profit sharing ratio is 3 : 1 : 1. C brings ₹ 25,000 as capital and amount of goodwill in cash.

Calculate the amount of C’s goodwill on the basis of adjusted capital and make Journal entry Goodwill.

Answer:

Calculation of Goodwill:

C’s share in Goodwill =

C’s Capital = ₹ 25,000

Total Capital of the firm = 25,000 ×

Capital of 3 Partners = 30,000 + 20,000 + 25,000 = ₹ 75,000 ……(b)

Goodwill (a – b) = 1,25,000 – 75,000 = ₹ 50,000

C’s share in Goodwill = 50,000 ×

Question 15.

How will you calculate the amount payable to the executors of deceased partner?

Answer:

Calculation of Amount Payable: Since the executors of the deceased partner have the right to receive share in the profits of the firm from the beginning of the year to the date of death, therefore, it is necessary to ascertain the profit for the aforesaid period. For ascertaining profits any of the following two methods can be adopted :

(I) On the basis of time,

(II) On the basis of turnover or sales

(I) On the basis of time:

Usually share of profit of a deceased partner is calculated on the basis Q”. time. If the time basis of used, the profit will be assumed to have arisen uniformly-, over the year. As such the period is compared to the remaining period (after death till the accounting date). The ratio of this time to the remaining period time shall be the basis for calculating the share of profit to be paid.

Formula for calculating:

Deceased Partner’s share in Profit =

(II) On the basis of Turnover or Sales :

Sometimes partners may decide to calculate share of profit on the basis of turnover or sales. Under this method, we should know two things : (a) the sales of the last (accounting) year, and (b) sales upto the death of the partner. The share of profit is calculated on the basis of current year’s sale or turnover till the date of death of the partner based on the rate of profit on last year’s total sales (turnover).

Formula for calculating :

Deceased Partner’s share in Profit = Sales upto the date of death × Rate of Profit × Share in Profit

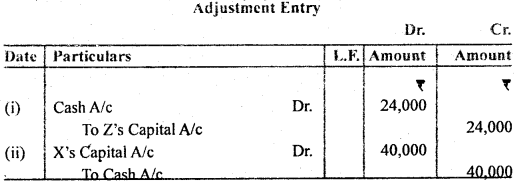

Question 16.

X, Y und Z are partners in a firm sharing profit in the ratio of 5 : 2 : 3. On 1st April, 2011. Y retires from the firm. X and Z agree that the capital of new firm shall be fixed at ₹ 4,00,000 in the profit sharing ratio. The capital accounts of X and Z after ait adjustments on the date of retirement showed balances of ₹ 2,90,000and ₹ 1,26,000 respectively. State the amount of actual cash to be brought in or to be paid off to the partners and make Journal entries.

Answer:

New Ratio of X and Z = 5 : 3

New Capital of the firm = ₹ 4,00,000

New Capital of X = 4,00,000 ×

New Capital of Z = 4,00,000 ×

Cash to be paid to X = 2,90,000 – 2,50,000 = ₹ 40,000

Cash to be brought in by Z = 1,50,000 – 1,26,000 = ₹ 24,000

Question 17.

Explain any three differences between Dissolution of Partnership and Dissolution of Firm.

Answer:

Difference between Dissolution of Partnership and Dissolution of Firm : The partnership Act recognises difference between dissolution of partnership and dissolution of firm. The main points of differences are as under :

1. Change in Relation : The dissolution of the firm implies a complete break-down of the partnership relation between all the partners whereas dissolution of the partnership merely involves a change in the relation of the partners.

2. Continuance of Business: Inn case of dissolution of firm, the business comes to an end whereas in case of dissolution of partnership, the business of the (reconstituted) firm is continued.

3. Effect: Dissolution of partnership does not necessarily mean dissolution of firm whereas dissolution of the firm necessarily implies dissolution of partnership.

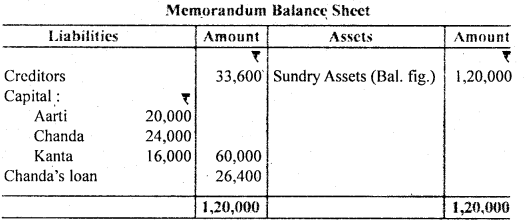

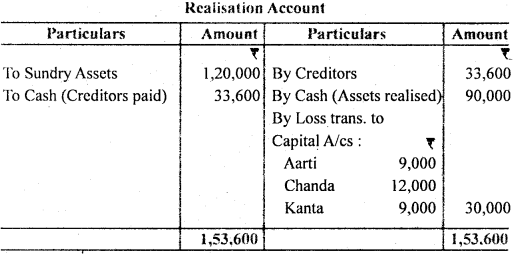

Question 18.

Arati, Chanda and Kanta are in partnership sharing profits in the ratio of 3 : 4 : 3. They decided to dissolve the partnership firm. At the date of dissolution their creditors amounted to ₹ 33,600. Their capitals stood at ₹ 20,000, ₹ 24,000 and ₹ 16,000 respectively. Chand had lent to the firm in addition to capital ₹ 26,400. The assets realised ₹ 90,000.

Prepare the Realisation Account.

Answer:

Question 19.

What is meant by dissolution of partnership? Give two circumstances under which a partnership is dissolved?

Answer:

Meaning of Dissolution of Partnership: Any change in the relations of the partners is called the dissolution of partnership. Thus, whenever a new partner is admitted or an old partner retires or dies, a partnership is reconstituted. In all those cases where a partnership is reconstituted, there is a dissolution of the partnership. In case of dissolution of partnership, the firm continues in a reconstituted form.

Reasons of Dissolution of Partnership :

- On retiring of a partners.

- On death of a partners.

Question 20.

On the dissolution of a firm 3/4th amount was realised from selling of machine worth ₹ 16,000. Pass entry for realisation.

Answer: